GlobalData’s latest report, ‘Permian Basin in the US, 2022 – Oil and Gas Shale Market Analysis and Outlook to 2026’, provides a detailed review of crude oil and natural gas appraisal and development in the Permian Basin in the context of the Covid-19 pandemic and the Russia-Ukraine conflict. The report also provides an outlook for oil and gas production in the Permian Basin through 2026, along with the competitive positioning of major operators.

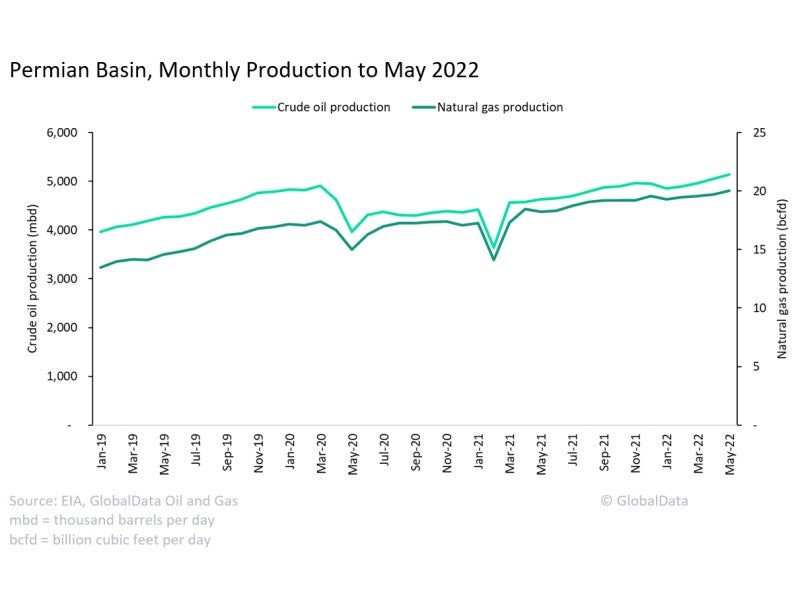

The Permian Basin shale, which is located in the states of Texas and New Mexico, is the largest oil-producing region in the US. In 2020, before the Covid-19 pandemic swept the US and the world, crude oil production in the play averaged more than 4.8 million barrels of oil per day (mmbd) from January to March. However, worldwide lockdowns and subsequent price slumps greatly affected production. As a result, crude oil production dropped below 4.0mmbd in May 2020 and then remained around 4.3mmbd through 2020. Natural gas production from the Permian Basin was relatively less affected during the pandemic. Gas production in the basin averaged 16.9 billion cubic feet per day (bcfd) in 2020.

Later, both crude and natural gas production in the play reached their lowest levels in February 2021, at 3.6mmbd and 14.1bcfd, respectively, registering a decline of 26% and 19% from their respective March 2020 levels. This decline can be mainly ascribed to a severe winter storm in Texas, which had a crippling effect on the oil and gas infrastructure in the region.

Since March 2021, crude production in the basin recovered gradually and averaged 4.8mmbd in 2021. Natural gas production also saw a steady growth to 19.6bcfd by December 2021.

The production in the region surpassed pre-pandemic levels in 2022, with crude oil and natural gas production amounting to 5.1mmbd and 20.1bcfd, respectively.

Globally, oil prices have been rising lately, owing to rising global energy demand and crude supply shortages. Furthermore, the Russia-Ukraine war and the resulting sanctions on Russia have forced numerous companies, including oil majors such as BP, Shell and ExxonMobil, to exit the Russian oil and gas industry amid rising concerns over Western sanctions. This is expected to boost the US shale, as some of these companies could potentially divert the capital allocated for Russian assets to their shale acreages to capitalise on mounting oil prices.

According to GlobalData, Lea and Eddy in New Mexico and Reeves, Love, Midland, Martin, Howard, Culberson, Upton and Ward in Texas are the leading counties of Permian Basin. Major crude oil and natural gas producers include Pioneer Natural Resources, Chevron, Occidental Petroleum, ConocoPhillips and Exxon Mobil.