The oil & gas industry continues to be a hotbed of innovation, with activity driven by the need to improve safety, enhance productivity, and reduce operational costs and growing importance of technologies such as machine learning, big data, artificial intelligence, and IoT. In the last three years alone, there have been over 534,000 patents filed and granted in the oil & gas industry, according to GlobalData’s report on Internet of Things in Oil & Gas: AI assisted drone control.

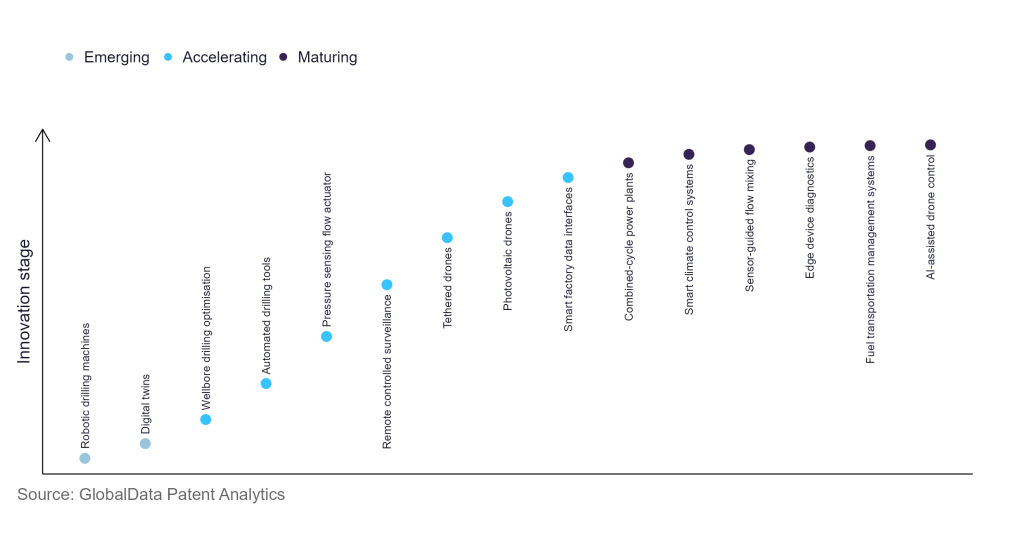

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

150+ innovations will shape the oil & gas industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the oil & gas industry using innovation intensity models built on over 256,000 patents, there are 40+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, robotic drilling machines and digital twins are disruptive technologies that are in the early stages of application and should be tracked closely. Wellbore drilling optimisation, automated drilling tools, and pressure sensing flow actuator are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are combined cycle power plants and smart climate control systems, which are now well established in the industry.

Innovation S-curve for Internet of Things in the oil & gas industry

AI-assisted drone control is a key innovation area in Internet of Things

Intelligent control uses various computation methodologies such as fuzzy logic, neural networks, Bayesian probability, evolutionary computation, machine learning, genetic algorithms, and reinforcement learning. All these computational methods are used to control drones.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10+ companies, spanning technology vendors, established oil & gas companies, and up-and-coming start-ups engaged in the development and application of AI-assisted drone control.

Key players in AI-assisted drone control – a disruptive innovation in the oil & gas industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to AI-assisted drone control

| Company | Total patents (2010 - 2021) | Premium intelligence on the world's largest companies |

| General Electric | 41 | Unlock company profile |

| Honeywell International | 32 | Unlock company profile |

| Halliburton | 31 | Unlock company profile |

| Deere & Co | 28 | Unlock company profile |

| Saudi Arabian Oil | 16 | Unlock company profile |

| Mitsubishi Heavy Industries | 12 | Unlock company profile |

| Brunswick | 10 | Unlock company profile |

| Siemens | 9 | Unlock company profile |

| Caterpillar | 6 | Unlock company profile |

| Johnson Controls International | 6 | Unlock company profile |

| USIC | 6 | Unlock company profile |

| Oceaneering International | 6 | Unlock company profile |

| Yokogawa Electric | 5 | Unlock company profile |

| Vtrus | 5 | Unlock company profile |

| Hyundai Motor Group | 5 | Unlock company profile |

Source: GlobalData Patent Analytics

General Electric is one of the leading patent filers in AI-assisted drone control. It formed an alliance with NVIDIA (a leading company in AI technology) through its inspection business, Avistas Systems, that helps to ensure safety at complex work sites such as refineries.

Honeywell International is another company that plays significant role in AI-assisted drone control. It formed a new business, Unmanned Aerial Systems (UAS), in 2020 to meet the needs of industries in Unmanned Aerial Systems and Urban Air Mobility (UAM). Software development is one of the focus areas of this new company, which plans to use AI software to find perfect vertical landing areas for drones.

AI provides an impressive analytical advantage for data collected by drones. This forms the basis for advanced inspection strategies, including predictive maintenance and asset management. AI-assisted drone deployment is likely to grow in the oil and gas industry over this decade due to continued digitalisation efforts in the industry. Declining hardware costs and increasing adoption rates will further facilitate a rise in drone deployment in the industry. Already a wide variety of drone solutions equipped with sensing and imaging technologies and analytical features have been adopted within the industry.

To further understand how Internet of Things is disrupting the oil & gas industry, access GlobalData’s latest thematic research report on Internet of Things in Oil & Gas (2021).