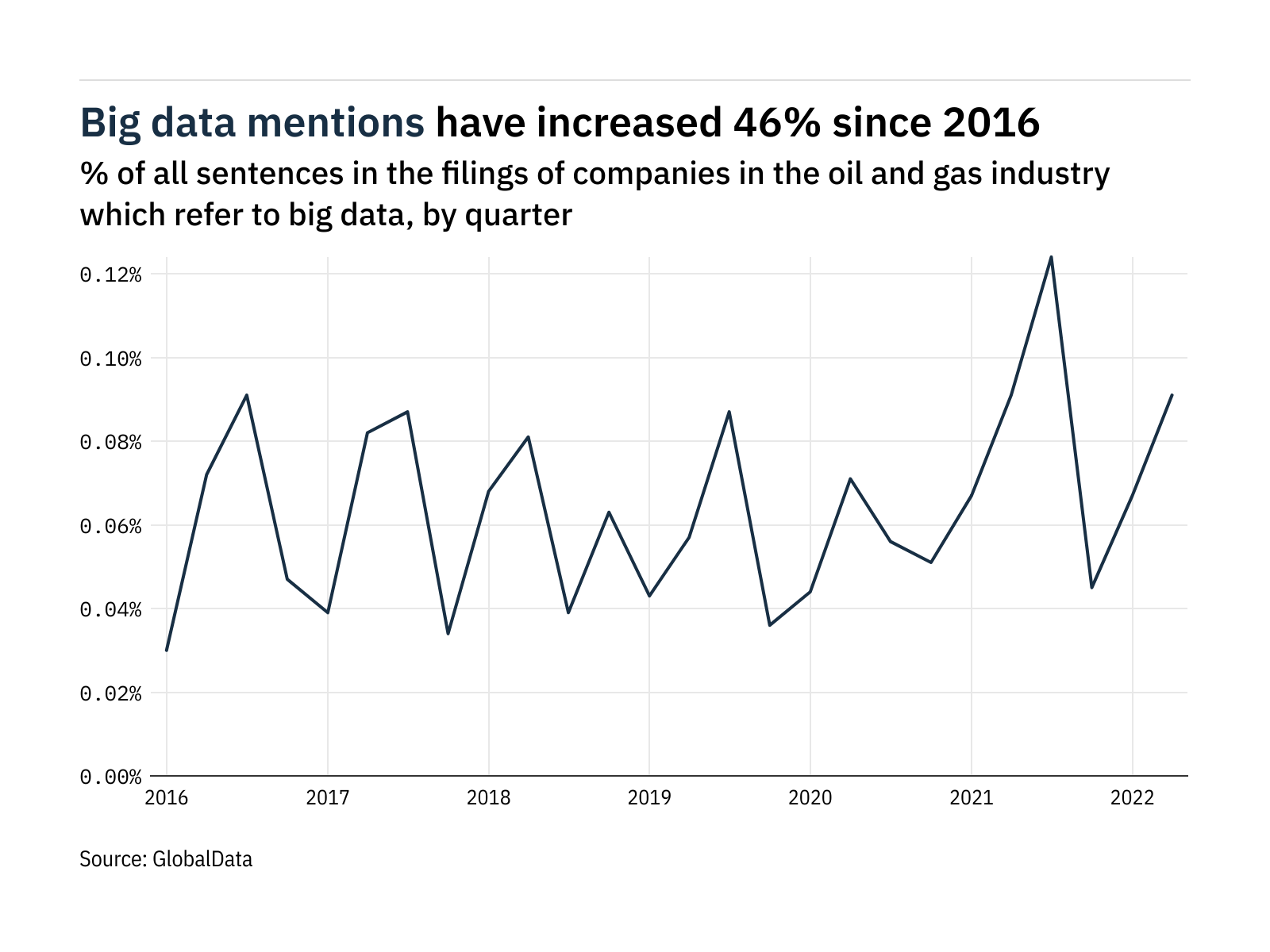

Mentions of big data within the filings of companies in the oil and gas industry rose 36% between the first and second quarters of 2022.

In total, the frequency of sentences related to big data between July 2021 and June 2022 was 46% higher than in 2016 when GlobalData, from whom our data for this article is taken, first began to track the key issues referred to in company filings.

When companies in the oil and gas industry publish annual and quarterly reports, ESG reports and other filings, GlobalData analyses the text and identifies individual sentences that relate to disruptive forces facing companies in the coming years. Big data is one of these topics - companies that excel and invest in these areas are thought to be better prepared for the future business landscape and better equipped to survive unforeseen challenges.

To assess whether big data is featuring more in the summaries and strategies of companies in the oil and gas industry, two measures were calculated. Firstly, we looked at the percentage of companies which have mentioned big data at least once in filings during the past twelve months - this was 67% compared to 46% in 2016. Secondly, we calculated the percentage of total analysed sentences that referred to big data.

Of the 10 biggest employers in the oil and gas industry, Rosneft was the company which referred to big data the most between July 2021 and June 2022. GlobalData identified eight big data-related sentences in the Russia-based company's filings - 0.3% of all sentences. 3M mentioned big data the second most - the issue was also referred to in 0.3% of sentences in the company's filings. Other top employers with high big data mentions included Lukoil, RIL and Honeywell.

Across all companies in the oil and gas industry the filing published in the second quarter of 2022 which exhibited the greatest focus on big data came from Keppel. Of the document's 2,341 sentences, 45 (1.9%) referred to big data.

This analysis provides an approximate indication of which companies are focusing on big data and how important the issue is considered within the oil and gas industry, but it also has limitations and should be interpreted carefully. For example, a company mentioning big data more regularly is not necessarily proof that they are utilising new techniques or prioritising the issue, nor does it indicate whether the company's ventures into big data have been successes or failures.

GlobalData also categorises big data mentions by a series of subthemes. Of these subthemes, the most commonly referred to topic in the second quarter of 2022 was 'data centers', which made up 51% of all big data subtheme mentions by companies in the oil and gas industry.