The Middle East is expected to witness 621 projects commence operations during the period 2023–2027. Out of these, upstream projects would be 81, midstream would be 141, the refinery at 84, and petrochemicals would be the highest with 315 projects.

Downstream (refineries) and petrochemical projects together constitute about 64% of all upcoming oil and gas projects in the Middle East during 2023–2027. The midstream sector follows next, with the pipeline segment constituting 40% of all projects, followed by oil storage and gas processing with 23% and 21%, respectively.

New build projects lead the upcoming project landscape in the Middle East, constituting around 78% of the total projects across the value chain. The share of new build projects is especially high in the petrochemicals sector accounting for 60% of the total new build projects across the value chain. On the other hand, expansion projects dominate the downstream (refineries) sector with 43%.

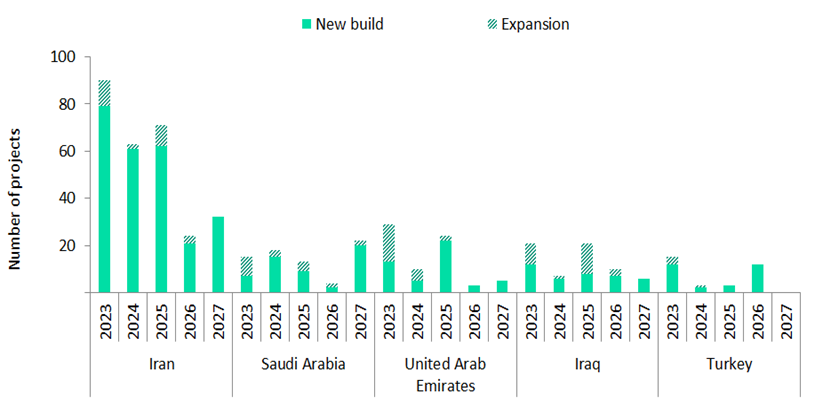

Oil and gas projects in the Middle East, projects by key countries, 2023–2027

In the Middle East, more than half of the projects are in the construction and commissioning stages and are more likely to commence operations during the outlook period 2023–2027. About 34% of the projects are in the planning stages, and the rest have been approved or awaiting approval.

Among countries, Iran leads the upcoming projects landscape in the Middle East, accounting for 45% of the projects expected to start operations by 2027. Further details of Middle East projects can be found in GlobalData’s new report, Middle East Oil and Gas Projects Analytics and Forecast by Project Type, Sector, Countries, Development Stage, Capacity and Cost, 2023-2027.