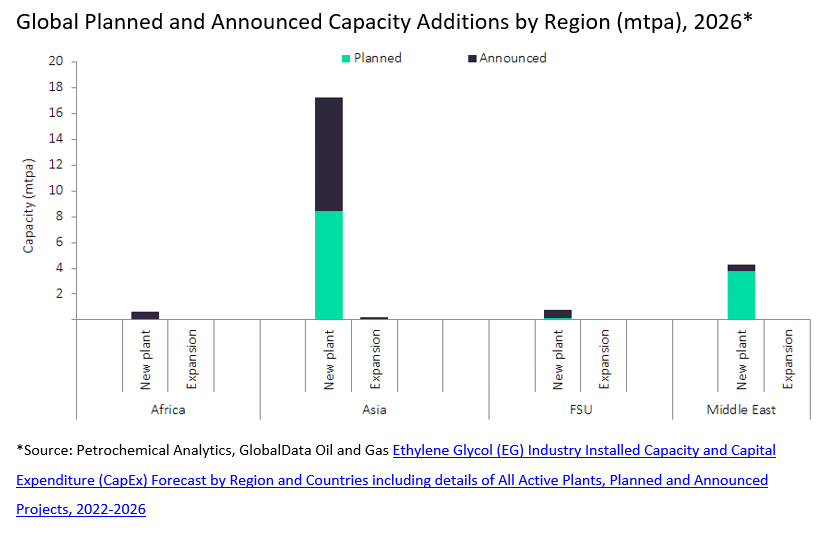

Global Ethylene Glycol (EG) capacity is poised to see considerable growth over the next five years, potentially increasing from 51.54 mtpa in 2021 to 77.02 mtpa in 2026, registering total growth of 49%. Around 49 planned and announced plants are slated to come online primarily in Asia and Middle East.

Within Asia, India has 10 planned and announced Ethylene Glycol capacity additions, with a total capacity of about 8.7 mtpa by 2026. The country is expected to spend a capital expenditure (capex) of US$4.9 billion. Major capacity additions will be from two announced projects Reliance Industries Jamnagar Ethylene Glycol (EG) Plant 2 and Haldia Petrochemicals Cuddalore Ethylene Glycol Plant.

In Middle East, the majority of capacity additions are from Iran with the capacity additions of about 3.29 mtpa. The country is expected to spend a total of US$2.66 billion by 2026. The major capacity additions are from two planned projects Bushehr Petrochemical Company Assaluyeh Ethylene Glycol Plant and Kangan Petro Refining Kangan Ethylene Glycol Plant each with capacity of 0.55 mtpa.

Reliance Industries Ltd, Haldia Petrochemicals Ltd and The National Petrochemical Co will be the top three companies globally in terms of planned and announced capacity additions over the upcoming years. Further details of long-term Ethylene Glycol 2022 can be found in GlobalData’s new report, ‘Ethylene Glycol (EG) Industry Installed Capacity and Capital Expenditure (CapEx) Forecast by Region and Countries including details of All Active Plants, Planned and Announced Projects, 2022-2026’.