Asia-Pacific is expected to witness 2,040 projects commence operations during the period 2023–27. Out of these, upstream projects would be 230, midstream would be 564 projects, refinery would be at 242 and petrochemicals would be the highest with 1,004 projects.

In the midstream sector, the trunk/transmission pipelines segment alone constitutes 37% of all projects followed by LNG and oil storage with 30% and 24% respectively. Refinery and petrochemical projects constitute around 61% of all upcoming oil and gas projects in Asia-Pacific from 2023–27.

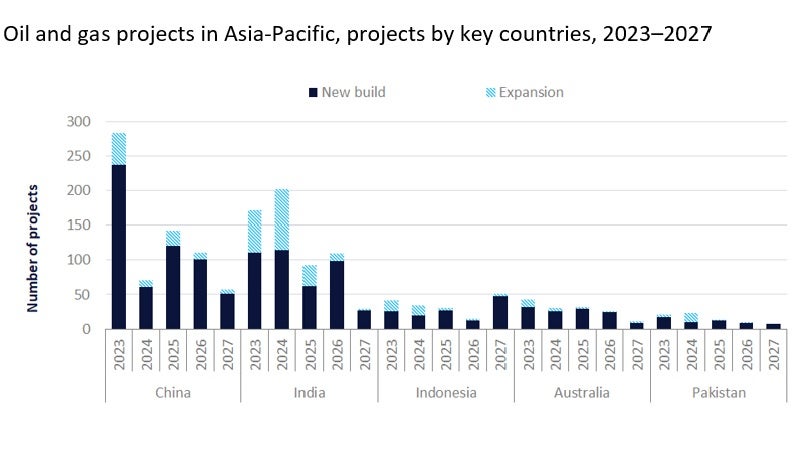

New-build projects dominate the upcoming projects landscape in Asia-Pacific constituting around 78% of the total projects across the value chain. The share of new-build projects is especially high in the petrochemical sector with 54% of the total new-build projects across the value chain. On the other hand, expansion projects lead in the downstream (refinery) sector.

Among countries, China dominates the upcoming projects landscape in Asia-Pacific, accounting for 33% of the total projects expected to start operations by 2027.

In Asia-Pacific, about 43% of the projects are in the construction and commissioning stages and are more likely to commence operations during the outlook period. About 31% of the projects have been approved or awaiting approval while the rest are in the planning stages.

Further details of oil and gas projects expected to start operations in Asia-Pacific across the value chain can be found in GlobalData’s new report, ‘Asia-Pacific (APAC) Oil and Gas Projects Analytics and Forecast by Project Type, Sector, Countries, Development Stage, Capacity and Cost, 2023-2027‘.