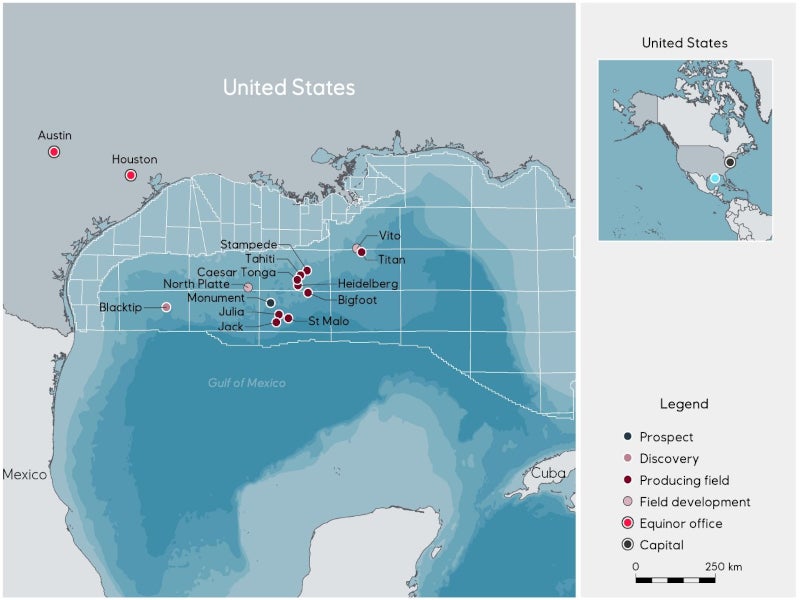

The North Platte oil field is planned to be developed in 1,300m-deep waters of the Gulf of Mexico, about 275km offshore Louisiana, US.

Norwegian oil and gas company Equinor holds 40% non-operating interest in North Platte. TotalEnergies (Total), a French oil and gas company and the operator of the project, held the remaining 60% interest in the deepwater oil field.

Cobalt International Energy (Cobalt) had 60% operating interest in the North Platte discovery. Total, which had held the remaining 40% interest, acquired an additional 20% interest from Cobalt for $339m, as part of the latter’s bankruptcy auction sale, in March 2018.

Equinor joined as a partner by acquiring Cobalt’s remaining 40% interest in North Platte.

The front-end engineering and design (FEED) for the project was launched in December 2019.

In February 2022, Total decided to withdraw from the North Platte deepwater project and relinquish the operatorship, in order to allocate capital to more promising projects within its global portfolio.

North Platte location, discovery and reservoir details

The North Platte deepwater oil development project spans four blocks in the Garden Banks area of the US Gulf of Mexico.

Total and Cobalt discovered the oil field by drilling an exploratory well to a total depth of 10,520m (34,500ft) in December 2012.

The discovery well intercepted several hundred feet of net oil pay and a number of high-quality intervals in the Lower Tertiary sandstones of the Wilcox Formation.

The field was subsequently appraised by three appraisal wells and three sidetracks.

North Platte is considered a high-quality asset, both in terms of porosity and permeability, with the thickness of the reservoir exceeding 1,200m in several locations.

North Platte field development details

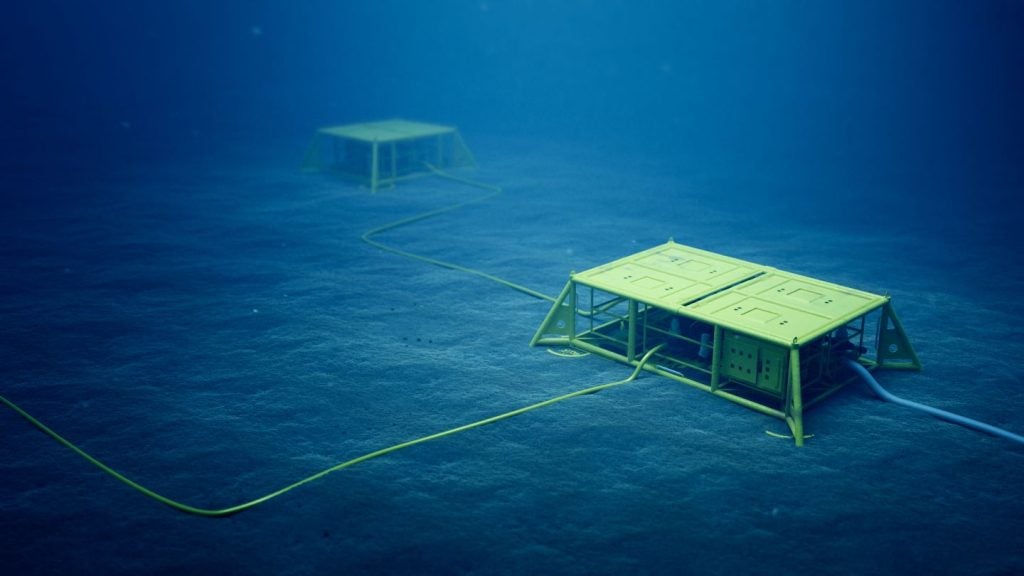

The deepwater oil field is planned to be developed by drilling eight wells from two subsea drilling facilities and tying back the subsea wells to a new, lightweight semi-submersible floating production unit (FPU) through two production loops. The FPU will be designed to accommodate additional tie-ins in future.

Valaris DS-11 drillship will be utilised to perform development drilling for the project. The drillship will be upgraded with the installation of a 20,000 pounds-per-square-inch (psi) well control equipment before starting drilling at the high-pressure oil field.

The North Platte oil field is expected to produce 75,000 barrels of oil per day (bpd) at plateau level. The output will also include associated gas.

Contractors involved

Worley, an Australian engineering services firm, received a contract to provide FEED services for the North Platte deepwater project in January 2020, following the completion of the pre-FEED phase in August 2019.

It leveraged its FPU topside design capability along with its subsidiary Intecsea’s expertise in the design of the hull, mooring and subsea pipelines, to offer cost-effective, lightweight deepwater solutions.

Offshore drilling services provider Valaris secured a development drilling contract with an estimated duration of three and a half years for the North Platte field development from Total in 2021. Total’s withdrawal from the project, however, could affect the contract, which is planned to be executed from mid-2024.

Total and Equinor’s assets in the US Gulf of Mexico

Total has working interests in the producing deepwater Jack and Tahiti oil fields in the US Gulf of Mexico, in partnership with Equinor and Chevron.

The company also co-owns the producing Chinook oil field, and the underdevelopment Anchor and Ballymore deep offshore projects located in the US Gulf of Mexico.

Equinor holds working interests in producing Caesar Tonga, Heidelberg, Julia, St Malo, Stampede, Titan, and Big Foot fields in the Gulf of Mexico. It also holds 37% interest in the Vito oil field, which is currently under development.