:max_bytes(150000):strip_icc()/Farm202-2000-b6035afa095244c3b0ad5d836d529e12.jpg)

"Farmland is all we do every day, all day," says Carter Malloy, CEO of AcreTrader.

Malloy founded the company in 2018 after he and a neighbor realized there was no easy way to invest in farmland online. Not only does AcreTrader fill the gap between investment capital looking for a home, it also helps farm businesses looking to grow.

How it Works

With a few clicks on the AcreTrader website, investors can create an account and begin buying shares electronically to diversify their portfolios in farmland.

AcreTrader creates a seamless process for investors by reviewing available land and working with farmers or farm owners on operation management, administration, and investor relations.

"It's always very important for us to be in a true partnership with the farmer and to respect their way of operating their business," Malloy says.

AcreTrader has farmland experts on staff who work with local management companies to help fulfill each farmer's goals in any situation. About 40% of United States farmland is absentee owned and rented out. AcreTrader strives to be a low-friction absentee owner, one who is the best partner for the farmer.

They've helped farmers secure new land in their area to expand their farming operation and have raised additional funds for time-sensitive projects.

"Often, we will raise additional capital upfront for a farm," Malloy says. "If there is a necessary improvement that requires quick access to capital, we can easily help, rather than a renter having to repeatedly call an absentee owner over a period of months to secure improvements like new irrigation or drainage."

Partnering with Farmers

Shawn Peebles, an organic farmer in Arkansas, began working with AcreTrader in 2019 to secure new land to grow his high-production organic vegetable farm.

"What's unique about working with AcreTrader is I'm the one who found the ground," Peebles says. "I knew what I needed for sweet potatoes, for green beans, for edamame, but in my business, I'm concerned about building infrastructure. I don't have the available finances to do that and buy land too."

Peebles had looked at the parcel of land several times, which was very near his farmland, but couldn't commit on his own. With AcreTrader as a partner, however, he could make it work.

While partnering with AcreTrader has allowed Peebles to find new land to farm, the platform also offers him the opportunity to become an investor. "Not only can I increase my acres, but I can also invest a little money in land because the platform accommodates all kinds of investors," he says.

AcreTrader charges investors a flat, annual administration fee of 0.75% to 1.0% of the overall farm value, which is deducted from the income of the farm.

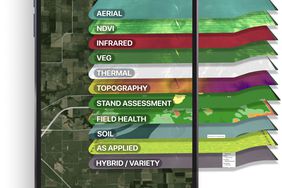

In addition to serving as a conduit between investors and farmland, the AcreTrader team can help manage farm transitions with complex family dynamics and ownership structures and offer guidance to farmers on new agriculture technology solutions.

:max_bytes(150000):strip_icc()/acretrader_logo-bbe4d3e565a243eca29e88fe054a8d04.png)

About the Company

Founder: Carter Malloy

Headquarters: Fayetteville, Arkansas

Website: acretrader.com

Background: This online marketplace allows users to invest in farmland, provides landowners access to capital, and lends management support to the farm operators.

Funding: Recently closed a seed round funding of over $5 million led by RZC Investments.